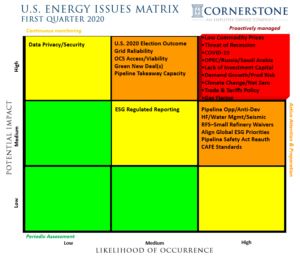

Cornerstone has issued its First Quarter US Energy Issues Matrix in the heat of the global COVID-19 pandemic and with the oil price war between Saudi Arabia and Russia in full swing.

Given the current situation, “COVID-19” and “Threat of Recession” have been added to the “High-High” red box in the Matrix. OPEC/Non-OPEC has been moved from “Medium Potential Impact-High Likelihood of Occurrence” to the “High-High” box and renamed “OPEC/Russia/Saudi Arabia” and “Geopolitical ME/Russia/China” is fused into that issue.

In the past two quarters, “Lack of Investment Capital” has been a “High-High” issue reflecting a trend of investor dollars moving away from fossil energy companies based on: 1) industry’s association with climate change; 2) a growing focus from investors on returns over growth; and 3) low commodity prices and slowing demand growth. The pandemic and global price war are exacerbating all of these factors and two other “High-High” issues: “Low Commodity Prices” and “Demand Growth/Prod Risk.”

So far, the US response to the oil price war has been diplomatic pressure and direct negotiations with Saudi Arabia. Industry is not united on its ask from government, with some calling for tariffs and bans on crude oil imports from certain countries, and others focused on areas like royalty relief, lease extensions, and modifications to the tax code. A letter from six US senators called on Secretary of State Mike Pompeo to take actions – tariffs, sanctions, or other measures – against Saudi Arabia unless the Kingdom changes its current oil policies.

“CAFE Standards” is another new addition to the Matrix this quarter. It is located in the “High Likelihood of Occurrence-Medium Potential Impact” box, reflecting the ongoing tension between the Trump Administration and the State of California over federal preemption of state tailpipe emissions regulations.

If you have any thoughts or comments on the latest Issues Matrix, please contact Jack Belcher at jbelcher@cgagroup.com.